Once the solitary-family direct homeownership mortgage can be so impactful in order to outlying residents, most are left https://paydayloancolorado.net/la-junta/ curious how USDA is able to eliminate it regarding. At all, unlike a number of other authorities-covered financing, new direct characteristics of one’s financing originates from the fact that consumers need to seek out its regional USDA work environment receive you to definitely, in lieu of handle a large financial company otherwise lender, as is the case that have Virtual assistant funds and you can FHA money. There are various most other oddities surrounding this new unmarried-family relations lead homeownership mortgage also, how does it works?

For just one, one particular burning matter of a lot debtor keeps is when the borrowed funds is able to feel thus affordable. In truth, the fresh new USDA possess said that the application form functions using percentage recommendations software to store the costs reduced. The latest financing into fee guidelines arises from subsidies whose sole purpose is to try to push the brand new month-to-month mortgage repayments and total loan cost low as a consequence of low interest rates without advance payment requirements.

Consumers are eligible for mortgage amounts based on the constraints enforced on their area of the USDA. Loan amounts also are partially influenced by a great borrower’s power to pay off the borrowed funds. It is computed upfront from Single Family unit members Homes Direct Qualification Comparison product , which will take into account situations as well as an excellent borrower’s monthly income, home composition, monthly expenses, property place, estimated assets taxes, and even estimated possibility insurance.

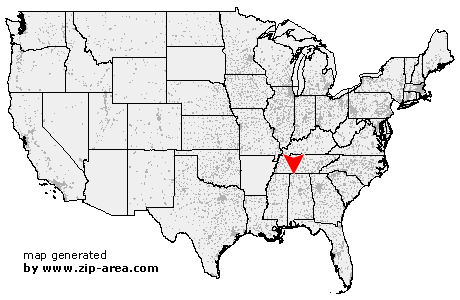

The latest USDA even offers a helpful product to search for the set money restrictions of the venue , in order for borrowers can also be influence the eligibility towards the system. In order for new loan’s will cost you are still affordable per borrower, you will find government legislation in place one to limit the estimated month-to-month house fee, insurance, a home taxation, or other expenses so you can 41% otherwise a reduced amount of the fresh borrower’s disgusting monthly income. If you find yourself there are not any strict direction as to what fico scores are expected towards the system, individuals can confirm that they’ll be able to settle the loan.

As if one to weren’t enough, new unmarried-household members direct homeownership loan can be utilized towards repair, repair or rehab away from a preexisting possessions otherwise property are ordered also

The single-family unit members direct homeownership loan itself is only considering because the a fixed price mortgage, having varying loan label lengths, based on what works perfect for brand new borrower. Through the available percentage guidelines, rates of interest towards the single-relatives lead homeownership loan is really as low as the step 1%. At the same time, loan conditions are supplied with prolonged regards to both 33 years, otherwise as much as 38 decades to have qualified consumers which may not have the ability to afford the monthly payments of one’s 33 season name.

Purposes for new USDA Single-family relations Head Homeownership Financing

The fresh money out-of a beneficial USDA single-members of the family head homeownership financing can be used according to recommendations put by the USDA rural innovation department. Once the financing doesn’t are from a loan provider, but rather new USDA itself, the mortgage continues can be used to have a multitude of employment. Consumers is make use of the unmarried-family unit members lead homeownership mortgage to order a different family, resolve a preexisting domestic, re-finance a home loan to eliminate foreclosure, or even build a new house.

The loan can also be accustomed security the expenses regarding transporting and you can starting a created the place to find another venue. Financing can be put on improvement of the webpages in itself, including linking the property so you can established municipal liquids or sewage lines.

The latest USDA allows funding getting used on construction toward a great home that would result in the family more affordable on borrower than other solutions. That actually comes with and also make enhancements on home to make it a great deal more available for somebody that have disabilities.